Our Values

What We Do

No more relying on multiple professionals; our integrated approach coordinates all the services you need to boost your lifestyle,

manage your hard-earned money, and plan for your family's current and future needs. Remember you don't have to settle for less.

Live your Best Life!

Asset

Management

Invest For Your Lifestyle, Retirement & Legacy

We believe that your investment strategy should be as unique as you are. Gone are the days of stereotyping investors with subjective semantics based on their age. At Centric, we act in your best interest and prove it quantitatively. Using a combination of the latest technology and our team of investment professionals, we continually evaluate and monitor your portfolio to ensure it’s aligned with you.

Our Asset Management Approach

It all starts with a Risk Number, a measurable way to pinpoint how much risk you want, need, and already have. Then, your wealth advisor will optimally allocate our investments to help you reach your financial goals. Along the way, you will receive transparency of information, seamless proactive service and the trust and accountability you need to stay on track. All of this will lead to your personal comprehensive investment strategy that is...

Powerful

Combining modern portfolio theory and behavioral economics

Disciplined

Executing actions based on observed market behaviors

Responsive

Weighing expectations against valuations, volatility, and correlations to keep things on track

AlphaTilt® Strategies

A proprietary, actively managed portfolio series based on long-term fundamentals and proper diversification. Strategically, at it’s core, AlphaTilt® is a concentrated portfolio of high-quality stocks. Tactically, AlphaTilt® employs tilts around that core corresponding to the prevailing business cycle. Through this duel strategy, AlphaTilt® aims to enhance risk-adjusted returns across all market phases.

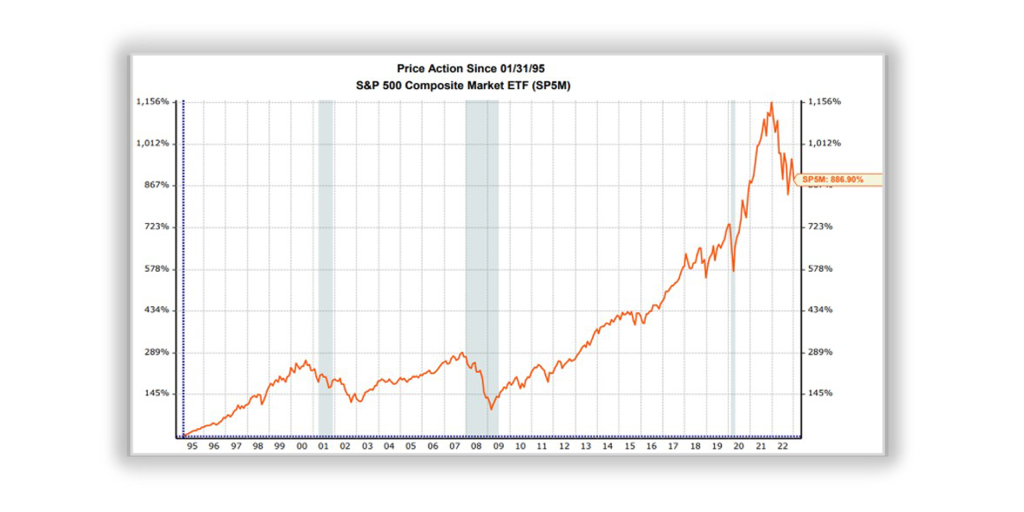

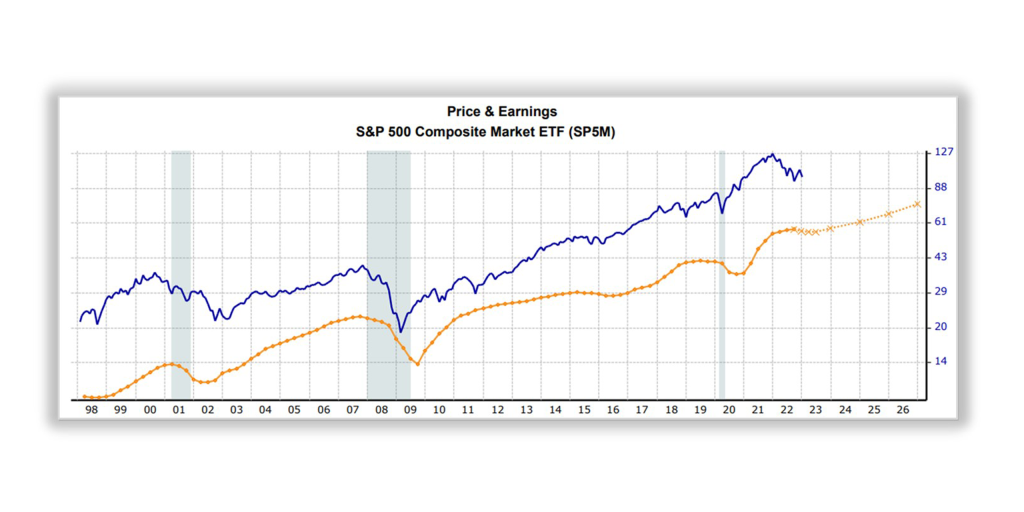

Moving Higher

Markets are volatile in the short term but consistently move higher over time.

Realistic Goals

Investors return objectives and risk constraints help investors set realistic long-term goals

Earnings

Security prices in the long-term are based on underlying company profits.

Competitiveness

Analyze company financials, including corporate profitability, relative to their peers.

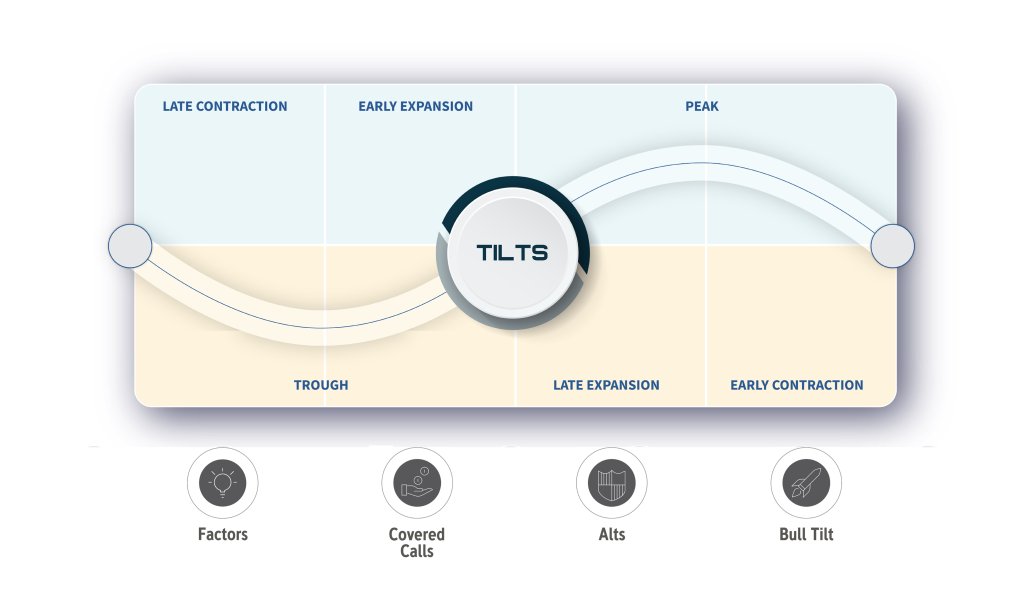

Business Cycle

Top-down analysis of economic cycle.

Active Management

Process of analyzing, selecting, and combining securities by Centric’s Investment Committee to generate excess returns.

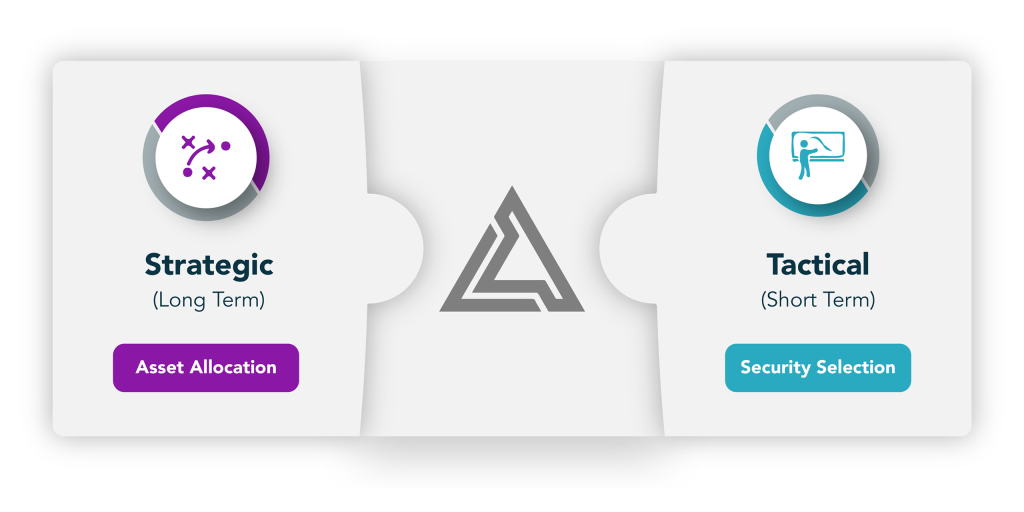

Strategic

Longer-term in nature. Asset allocation is shifted based on investor objectives and risk constraints.

Tactical

Shorter-term in nature. Asset allocation is maintained while individual securities are shifted based on fundamentals (ie: business cycle, corporate profits).

Excess Returns

Tactical in nature to generate Alpha; can be defensive or offensive.

Factors

Underlying characteristics of investment securities; macro and style.

Covered Calls

Securities used to generate additional income while participating in rising markets.

Alts

Securities with low correlation to major stock indexes.

Bull Tilt

Strategic subset of high-beta individual stocks.

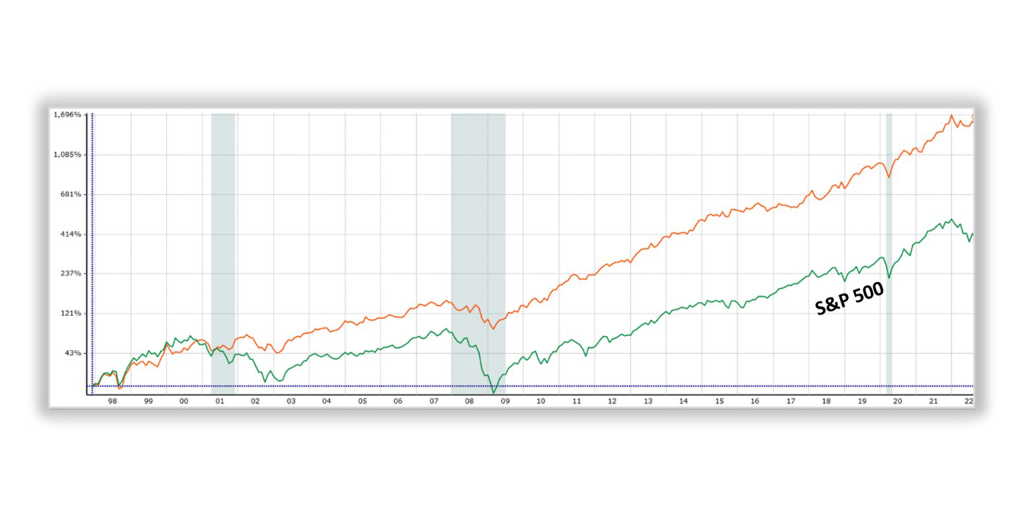

True Alpha

Defensive in nature but able to achieve superior risk-adjusted returns over the long-term.

AlphaTilt® Portfolios

AlphaTilt® Summary

AlphaTilt® aims to generate consistent and sustainable returns while minimizing the risk of capital loss across all market cycles. AlphaTilt® is:

- Actively managed

- Concentrated to 25-30 high quality stocks

- Tilted toward select securities

- Diversified

- Low cost

Private Investments

Sponsored by Centric Capital and offered to select clients of Centric; Private Investments, sometimes referred to as alternative investments, are nested in diverse asset classes beyond traditional markets.

Other

Foundation

Centric’s Foundation series, which consists of Voyager and Titan, are well built, dynamic portfolios that match your unique risk number. Foundations seek total return while diversifying risk exposures of various asset classes over the long-term.

Satellite

Our in-house expertise allows us to build around legacy positions and investment preferences.

Explorer

Purposefully built risk-based allocation models for those beginning their investment journey.

Financial Life

Management

Plan Wisely, Experience Life Fully

The best way to understand where you are now and where you’ll be in the future is to develop a personalized financial life plan. The process begins by understanding who you are and what matters most in your life. We’ll begin with a detailed discovery discussion to help us tailor recommendations to your situation. We’ll examine where you are now, where you’d like to be, and what financial milestones you hope you achieve along the way.

Planning Unifies All Aspects of Your Life

Our program encompasses all parts of your financial life and ensures that everything is working in concert with each other to build, grow, and protect your wealth.

Business Valuation

Provide valuation of business and key performance indicators based on information received from business owner

Cash Flow & Debt Planning

Provide detailed cash flow analysis for client, including providing advice on household expenses such as discretionary expenses and liability payments

Cash Value Insurance Review

Review existing life insurance policy, provide pros & cons of policy, obtain policy objective for client, prepare 1 alternative design

College Consulting

Analyze ability to qualify for college aid & receive customized student profile report comparing college costs

Financial Counseling

Advice on building financial skills, managing financial stress, and managing relationships with others involved in family matters

Financial Life Plan

Comprehensive financial planning with assistance in plan execution and monitoring progress for 12 months. Basic cash flow inputs (ie: total living expenses) included

Financial Life Plan Review

Review, track progress, and make adjustments based on new data & goals on Financial Life Plan initially created by Centric and reviewed within last 4 years

Next Life Divorce Analysis

In-depth financial analysis and advice to attorneys and couples related to divorce

Annuity Review

Review existing annuity policy, provide pros & cons of policy, obtain policy objectives for client, prepare 1 alternative design

Best Life Retirement Navigator

Identify current and future income sources and expenses. Review pros and cons of existing retirement plan. Give advice to improve success rate of retirement plan

Business Valuation

Provide valuation of business and key performance indicators based on information received from business owner

Financial Life Plan

Comprehensive financial planning with assistance in plan execution and monitoring progress for 12 months. Basic cash flow inputs (ie: total living expenses) included

Financial Life Plan Review

Review, track progress, and make adjustments based on new data & goals on Financial Life Plan initially created by Centric and reviewed within last 4 years

Individual Security Analysis

Review individual security and provide recommendation (ie: Buy, Hold, Sell)

Portfolio Risk Analysis

Quantify the amount of risk in a given portfolio (ie: Risk Score 55) and compare to risk tolerance of client

Stock Option Tax Analysis

Provide advice and tax implications on various types of stock options

Business Valuation

Provide valuation of business and key performance indicators based on information received from business owner

Cash Value Insurance Review

Review existing life insurance policy, provide pros & cons of policy, obtain policy objective for client, prepare 1 alternative design

Financial Life Plan

Comprehensive financial planning with assistance in plan execution and monitoring progress for 12 months. Basic cash flow inputs (ie: total living expenses) included

Financial Life Plan Review

Review, track progress, and make adjustments based on new data & goals on Financial Life Plan initially created by Centric and reviewed within last 4 years

Risk

Management

Managing Risk to Keep Your Financial Life on Track

A plan that is only successful if “everything goes right” is like a car without breaks. Our experts know that a plan is not sound without precautions taken, so we integrate strategies to minimize the financial damage of life’s uncertainties and unwelcomed events.

How We Do It

Advisory Team

Legacy of Unwavering Support

Our experienced advisors will guide you through all of your important financial decisions to help accomplish each goal and work with you to update the plan as your family, career, and life evolves.

Specialists

Work with the Best in the Business

Our team of carefully vetted specialists collaborate together to gain a well-rounded, multifaceted view of your financial situation in its entirety, allowing for the best possible strategies and outcomes for you.

Back Office

Streamlined for Simplicity and to Enhance your Experience

At Centric, we provide cutting edge knowledge, resources, and technology solutions backed by extensive and longstanding front line & back office support dedicated to your success.

Advisory Team

Specialists

Back Office

AS SEEN IN: