by Richard Cull

August Market Recap & Commentary

Commentary

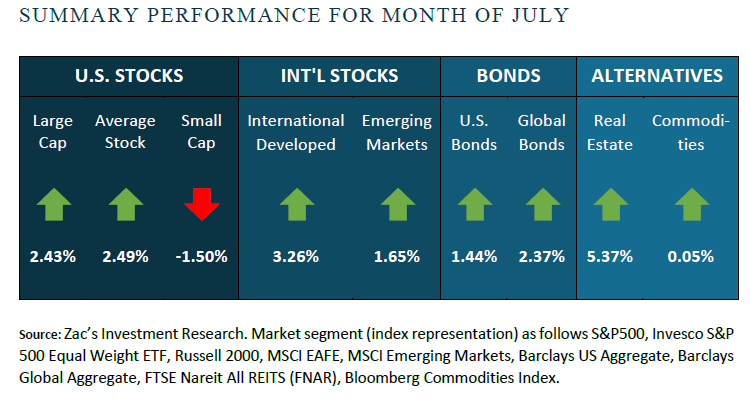

August was generally a month of positive investment results among the major assets classes. Small and mid-cap stocks were the exception as they gave back some of their outsized July gains.

I commented last month that August could be very interesting, which proved to be an understatement.

Three new items came out the second day of the month which pushed stocks lower; the unwinding of the Yen carry trade, a weak ISM Manufacturing number and an increased unemployment figure.

Let’s skip over the first two and focus on the unemployment rate which rose slighty to 4.3%. The market does not have an issue with that specific level (which is historically very low) but rather the speed with which it rose to that level (from 3.7% in January). This triggered the Samn Rule recession indicator named for economist Claudia Sahm, formerly of the Federal Reserve. The rational is very straightforward…rapidly rising unemployment is an indicator that the U.S. economy is in the early months of a recession. Combined with the other two pieces of news, the market began selling in earnest.

But as is always the case in the investment arena, there is no failsafe indicator.

I’ll let Yahoo Markets Reporter Josh Schafer add some validity with a recent piece.

It hasn't been a great time for folks in the business of predicting recessions.

The Conference Board's Leading Economic Index signaled a recession in 2022. The highly regarded Inverted Yield Curve recession indicator has been activated since November 2022. Even the commonly accepted layperson's definition of recession — two negative quarters of GDP — occurred in 2022.

But the latest failures also reveal a harsh truth about the recession prediction game: Recession indicators aren't perfect, and they likely never will be.

Just ask one of the most prominent recession indicator creators.

"The economy is so complex that ... it's unlikely that we get the perfect indicator," Duke University professor and Canadian economist Campbell Harvey, who invented the inverted yield curve indicator.

After a few dramatic down days, the market seemed to take a breath and reevaluate their newfound fear of a recession. As I stated earlier, by the end of the month all major asset classes finished higher!

Looking ahead to September, the latest unemployment figure will be released on the sixth and the Federal Reserve is expected to cut rates on the 18th. Stay tuned.

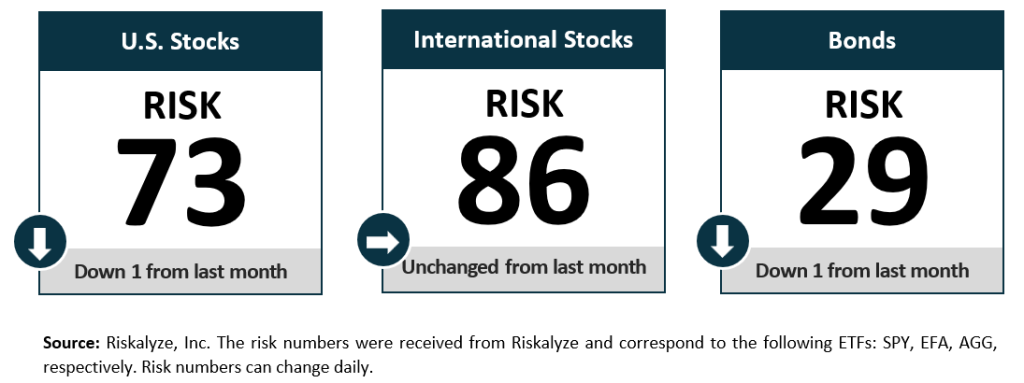

RISK NUMBERS

as of 09/03/2024

The Risk Number is at the heart of a sophisticated set of tools to precisely measure the appetite and capacity for risk that each client has and demonstrate their alignment with the portfolios built for them. The following graphic shows the risk of various asset classes as measured on a scale of 1-99 (1 being the most conservative and 99 being the most aggressive) as of the date above.

CENTRIC'S APPROACH

We start with a Risk Number, a measurable way to pinpoint how much risk you want, need, and already have. Then, your wealth advisor will optimally allocate our investments to help you reach your financial goals. Along the way, you will receive transparency of information, seamless proactive service and the trust and accountability you need to stay on track. All of this will lead to your personal comprehensive investment strategy that is powerful, disciplined, responsive.

Sources:

Centric’s Market Assumption Disclosures: This information is not intended as a recommendation to invest in any particular asset class or strategy or product or as a promise of future performance. Note that these asset class assumptions are passive, and do not consider the impact of active management. All estimates in this document are in US dollar terms unless noted otherwise. Given the complex risk-reward trade-offs involved, we advise clients to rely on their own judgment as well as quantitative optimization approaches in setting strategic allocations to all the asset classes and strategies. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Assumptions, opinions and estimates are provided for illustrative purposes only. They should not be relied upon as recommendations to buy or sell securities. Forecasts of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. If the reader chooses to rely on the information, it is at its own risk. This material has been prepared for information purposes only and is not intended to provide, and should not be relied on for, accounting, legal, or tax advice. The outputs of the assumptions are provided for illustration purposes only and are subject to significant limitations. “Expected” return estimates are subject to uncertainty and error. Expected returns for each asset class can be conditional on economic scenarios; in the event a particular scenario comes to pass, actual returns could be significantly higher or lower than forecasted. Because of the inherent limitations of all models, potential investors should not rely exclusively on the model when making an investment decision. The model cannot account for the impact that economic, market, and other factors may have on the implementation and ongoing management of an actual investment portfolio. Unlike actual portfolio outcomes, the model outcomes do not reflect actual trading, liquidity constraints, fees, expenses, taxes and other factors that could impact future returns. Asset allocation/diversification does not guarantee investment returns and does not eliminate the risk of loss.

Index Disclosures: Index returns are for illustrative purposes only and do not represent any actual fund performance. Index performance returns do not reflect any management fees, transaction costs or expenses. Indices are unmanaged and one cannot invest directly in an index.

Riskalyze Disclosure: The Risk Number® is a proprietary scaled index developed by Riskalyze to reflect risk for both advisors and their clients. The Risk Number is at the heart of a sophisticated set of tools to precisely measure the appetite and capacity for risk that each client has, and demonstrate their alignment with the portfolios built for them.

Shaped like a speed limit sign, the Risk Number gives advisors and investors a common language to use when setting expectations, recognizing risk and making portfolio selections. Just like driving faster increases hazards, a higher Risk Number equates with higher levels of risk.

General disclosure: This material is intended for information purposes only, and does not constitute investment advice, a recommendation or an offer or solicitation to purchase or sell any securities to any person in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. Reliance upon information in this material is at the sole discretion of the reader. Investing involves risks.

Get in Touch

Ready to take control of your finances and enjoy more of what matters in your life?