by Richard Cull

February 2021 Market Recap & Commentary

Commentary

Main Street seemed especially calm in February compared to the craziness over the last 13 months. The biggest news was severe cold blasting large swaths of the country rendering millions without power, heat and water and exposing short comings in our systems and preparedness.

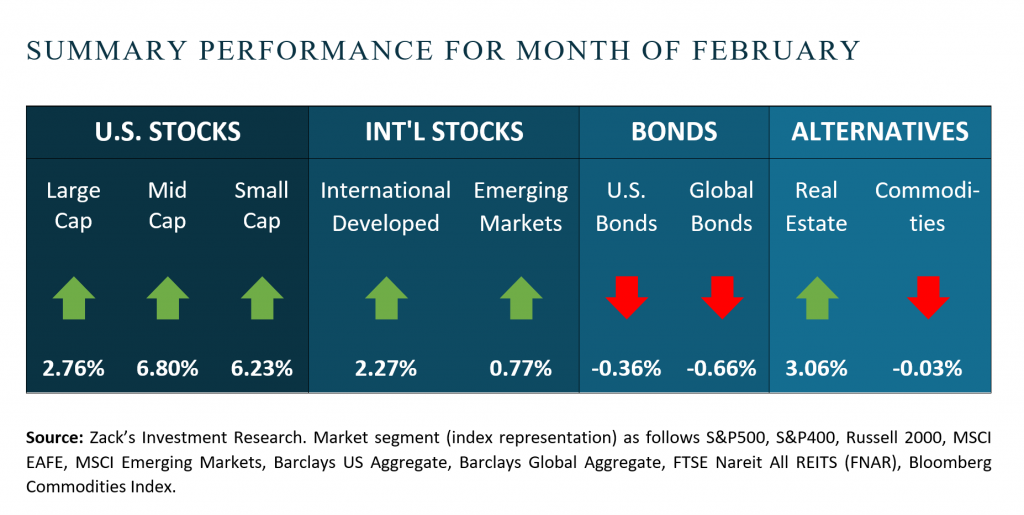

On Wall Street, assets generally rose but cooled their recent assents, especially the high-flying tech and Meme stocks. The reasoning behind this latest “pause” is best communicated in two parts.

Part A is the growing concern over rising inflation, meaning a general rise in the prices of goods & services. This concept from the past is usually caused by too many dollars chasing too few goods. With the continuing rounds of government stimulus and the ongoing easy money policies of the Federal Reserve, markets are justifiably fearful. Inflation was very ugly in the 1970’s averaging 7% a year and wreaking havoc on the economy and the markets. Since then, however, supply side innovations such as global sourcing and just-in-time inventories have kept inflation around 2.5% per year.

Part B is the concern that rising inflation will mean higher interest rates. When calculating “fair value” of securities a wide range of factors are considered including economic growth, profit margins, growth levers, competitive pressures, and interest rates. For fixed-income securities (bonds), rising rates means falling prices as investors sell existing bonds to buy newer, higher yielding bonds. For equities it means a higher discount rate when calculating the present value of future cash flows resulting in lower implied stock prices.

So putting the two parts together we see that investments, across almost all asset classes, decline in “value” with rising inflation. It is such an important tenet that the leading mandate of the United States Federal Reserve is to contain inflation (“…stable prices, and moderate long-term interest rates.”). Over the past 13 months Main Street and Wall Street have been greatly aided by the Fed’s policies but if unchecked those policies could lead to inflation.

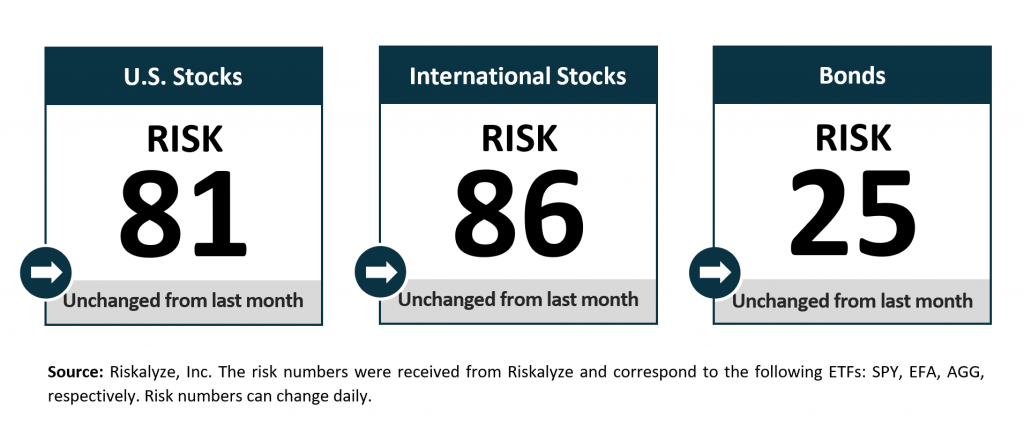

Risk Numbers

The Risk Number is at the heart of a sophisticated set of tools to precisely measure the appetite and capacity for risk that each client has, and demonstrate their alignment with the portfolios built for them. The following graphic shows the risk of various asset classes as measured on a scale of 1-99 (1 being the most conservative and 99 being the most aggressive) as of the date above.

Centric's Approach

We start with a Risk Number, a measurable way to pinpoint how much risk you want, need, and already have. Then, your wealth advisor will optimally allocate our investments to help you reach your financial goals. Along the way, you will receive transparency of information, seamless proactive service and the trust and accountability you need to stay on track. All of this will lead to your personal comprehensive investment strategy that is powerful, disciplined, responsive.

Sources:

Centric’s Market Assumption Disclosures: This information is not intended as a recommendation to invest in any particular asset class or strategy or product or as a promise of future performance. Note that these asset class assumptions are passive, and do not consider the impact of active management. All estimates in this document are in US dollar terms unless noted otherwise. Given the complex risk-reward trade-offs involved, we advise clients to rely on their own judgment as well as quantitative optimization approaches in setting strategic allocations to all the asset classes and strategies. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Assumptions, opinions and estimates are provided for illustrative purposes only. They should not be relied upon as recommendations to buy or sell securities. Forecasts of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. If the reader chooses to rely on the information, it is at its own risk. This material has been prepared for information purposes only and is not intended to provide, and should not be relied on for, accounting, legal, or tax advice. The outputs of the assumptions are provided for illustration purposes only and are subject to significant limitations. “Expected” return estimates are subject to uncertainty and error. Expected returns for each asset class can be conditional on economic scenarios; in the event a particular scenario comes to pass, actual returns could be significantly higher or lower than forecasted. Because of the inherent limitations of all models, potential investors should not rely exclusively on the model when making an investment decision. The model cannot account for the impact that economic, market, and other factors may have on the implementation and ongoing management of an actual investment portfolio. Unlike actual portfolio outcomes, the model outcomes do not reflect actual trading, liquidity constraints, fees, expenses, taxes and other factors that could impact future returns. Asset allocation/diversification does not guarantee investment returns and does not eliminate the risk of loss.

Index Disclosures: Index returns are for illustrative purposes only and do not represent any actual fund performance. Index performance returns do not reflect any management fees, transaction costs or expenses. Indices are unmanaged and one cannot invest directly in an index.

Riskalyze Disclosure: The Risk Number® is a proprietary scaled index developed by Riskalyze to reflect risk for both advisors and their clients. The Risk Number is at the heart of a sophisticated set of tools to precisely measure the appetite and capacity for risk that each client has, and demonstrate their alignment with the portfolios built for them.

Shaped like a speed limit sign, the Risk Number gives advisors and investors a common language to use when setting expectations, recognizing risk and making portfolio selections. Just like driving faster increases hazards, a higher Risk Number equates with higher levels of risk.

General disclosure: This material is intended for information purposes only, and does not constitute investment advice, a recommendation or an offer or solicitation to purchase or sell any securities to any person in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. Reliance upon information in this material is at the sole discretion of the reader. Investing involves risks.

Get in Touch

Ready to take control of your finances and enjoy more of what matters in your life?