by Oscar R. Mondragon

Investing in a 529 Plan – Is It a Good Idea?

There is a huge gap in the purchasing power parity (PPP) of Millennials and Baby Boomers. The difference between what both generations could buy for the same money has become like night and day. Take housing, for example. Real estate wasn’t as expensive as it is now, and now that Baby Boomers are looking to sell their houses, Millennial aren’t as interested as they should be.

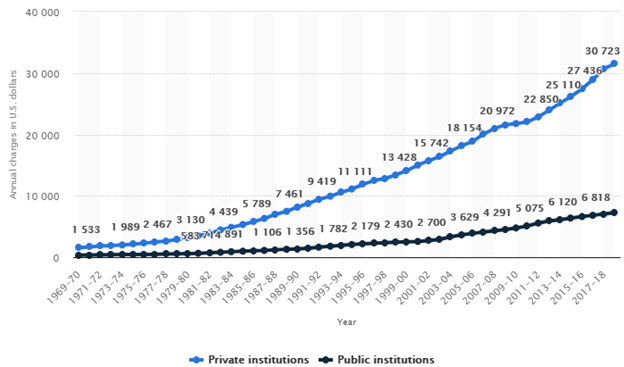

Higher education expenses, yet another area where the same principle is applicable. Here is a graph showing how the average has increased over the years.

Source: Statista

For most parents, this is a cause for great concern and therefore a cause to start saving for college (or form trusts). Grandparents have the option of saving for grand kids by opening 529 plan accounts. According to Fidelity, the number of grandparent-owned 529 plans is on the rise. However, a question arises; is it a good idea?

529 Plan for My Grand Kids - Is It a Good Idea?

Although many parents appreciate the helping hand from grandparents for educational needs, there are several pitfalls as well that you should be aware of. Here, we’ll discuss the pros and cons of a 529 plan to help you make an informed decision.

Benefits of a 529 Plan

Tax-Free Growth

The funds grandparents put in a 529 plan grow year-on-year – and that too, without any taxes. This includes federal and state/local taxes as well. Since growth is tax-free, you get to save even more for your little ones.

Tax-Free Withdrawls

Just like growth isn’t taxable in 529 plans, withdrawals made for the purpose of payment for a qualified higher education expense (which includes tuition, room and board expense, cost of books and exams, and more) are completely tax-free as well.

Transferrable

With individual 529 plans you can change beneficiaries (the child who the money is going to be used for) without negative income tax consequences – if, say, the original beneficiary decides that a college degree isn’t for them – as long as the new beneficiary is a member of the original beneficiary’s family. Qualified family includes the beneficiary’s siblings, parents, children, first cousins, nieces and nephews, among others.

Get in Touch with a Centric Advisor

Why a 529 Plan Could Be a Bad Idea

You'll Pay Taxes if You Need the Money

Should you, as a grandparent, ever need extra funds – if, say, for your medical needs – the 529 plan becomes taxable. This means that you – the grandparent – can use the funds as and when you need to, but when withdrawing funds, you will have to pay taxes on them since the withdrawals aren’t used for education.

Also, in some states, funds in a 529 plan account are considered countable Medicaid assets.

It May Impact Your Grand Kids' Financial Aid Eligiblity

One should be aware that having assets in a parent owned 529 plans will affect the child’s ability to qualify for financial aid, while having assets in a grandparent owned 529 plans will not affect a child’s ability to qualify for financial aid (under FAFSA, CSS Profile is different) while the money is sitting there. However, taking withdrawals from a grandparent owned 529 plan could affect your grandchild’s ability to qualify for financial aid in subsequent years. For every $2 taken out, your grandchild’s financial aid may be reduced by $1. It is quite possible that financial aid could be eliminated completely.

If you’d like to learn more about how a 529 plan works or whether it’s the right choice for you, we recommend you get in touch with Centric professionals. We’ll be glad to help you sort out all your saving and education planning worries!

Get in Touch

Ready to take control of your finances and enjoy more of what matters in your life?