by Richard Cull

June 2022 Market Recap & Commentary

Commentary

The month of June saw negative returns for all major asset classes. As evidenced by the mid-month rally, June continued the theme of uncertainty fueling extreme two-way volatility. When the closing bell rang, returns for the month, the quarter, and the first half of 2022 were meaningfully lower.

It is unpleasant to experience such persistent downward pressure in the markets while also hearing negative headline after negative headline in the news. The “Big Three” of rising inflation, tightening Federal Reserve, and war in Ukraine are not only being reported by the media but are now being experienced on a very personal level.

Prices of everything from essentials (gasoline, food, etc.) to discretionary items (airfare, hotel rates etc.) have risen seemingly overnight, or more accurately since the tail end of the pandemic. Some of this is a direct result of supply chain disruptions arising from global lockdowns and some of this is a consequence of the easy money policies by the Federal Reserve and Federal government dating back to the great recession (2008).

The taming of this inflation will be done through a combination of three things: 1) The Fed will continue to raise interest rates and pull liquidity from the economy, 2) supply chain backlogs will ease and 3) elevated prices will lead to lower consumption in accordance with the old adage, ”high prices are the solution to high prices.”

These steps are known by the markets and the negative returns thus far reflect this information. The certainty is the economy will slow; the big uncertainty is to what extent? The Fed believes the economy will still expand in 2022 albeit at a pedestrian 1.7% pace. Others, including astute economists believe a recession sometime in the next 12 months is inevitable and perhaps has already begun.

In reality, no one knows what will happen… it is UNKNOWABLE… too many factors, too many variables, too many parties with competing interests.

As seasoned investors, these are the times we draw on experience and chose to thoroughly parse all new information, be cognizant of investor emotions (especially fear) and act deliberately rather than rashly. As Warren Buffet vehemently preaches, true investing is long-term in nature. Focus not on the next five months but on the next five years. This may feel like a storm from 1970, 2000 or 2008…but assuredly it is not. This too will pass, calm will return, and asset prices will grow to much higher levels.

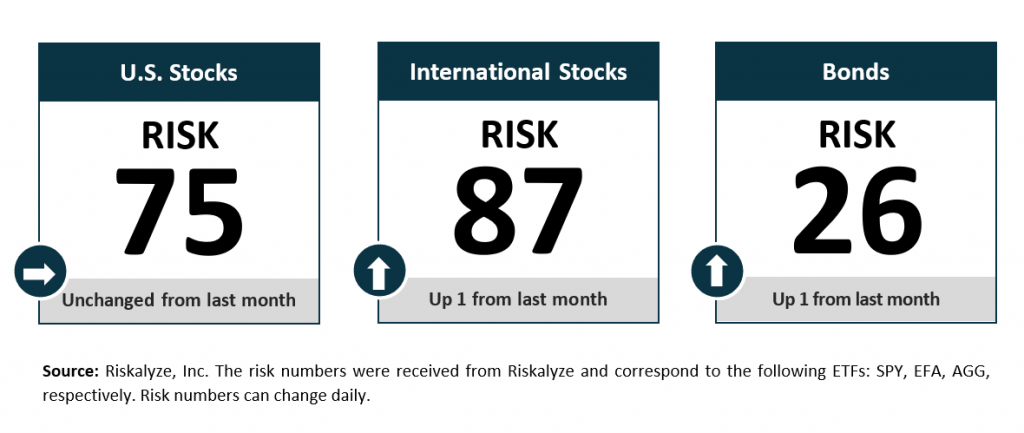

Risk Numbers

The Risk Number is at the heart of a sophisticated set of tools to precisely measure the appetite and capacity for risk that each client has, and demonstrate their alignment with the portfolios built for them. The following graphic shows the risk of various asset classes as measured on a scale of 1-99 (1 being the most conservative and 99 being the most aggressive) as of the date above.

CENTRIC's Approach

We start with a Risk Number, a measurable way to pinpoint how much risk you want, need, and already have. Then, your wealth advisor will optimally allocate our investments to help you reach your financial goals. Along the way, you will receive transparency of information, seamless proactive service and the trust and accountability you need to stay on track. All of this will lead to your personal comprehensive investment strategy that is powerful, disciplined, responsive.

Sources:

Centric’s Market Assumption Disclosures: This information is not intended as a recommendation to invest in any particular asset class or strategy or product or as a promise of future performance. Note that these asset class assumptions are passive, and do not consider the impact of active management. All estimates in this document are in US dollar terms unless noted otherwise. Given the complex risk-reward trade-offs involved, we advise clients to rely on their own judgment as well as quantitative optimization approaches in setting strategic allocations to all the asset classes and strategies. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Assumptions, opinions and estimates are provided for illustrative purposes only. They should not be relied upon as recommendations to buy or sell securities. Forecasts of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. If the reader chooses to rely on the information, it is at its own risk. This material has been prepared for information purposes only and is not intended to provide, and should not be relied on for, accounting, legal, or tax advice. The outputs of the assumptions are provided for illustration purposes only and are subject to significant limitations. “Expected” return estimates are subject to uncertainty and error. Expected returns for each asset class can be conditional on economic scenarios; in the event a particular scenario comes to pass, actual returns could be significantly higher or lower than forecasted. Because of the inherent limitations of all models, potential investors should not rely exclusively on the model when making an investment decision. The model cannot account for the impact that economic, market, and other factors may have on the implementation and ongoing management of an actual investment portfolio. Unlike actual portfolio outcomes, the model outcomes do not reflect actual trading, liquidity constraints, fees, expenses, taxes and other factors that could impact future returns. Asset allocation/diversification does not guarantee investment returns and does not eliminate the risk of loss.

Index Disclosures: Index returns are for illustrative purposes only and do not represent any actual fund performance. Index performance returns do not reflect any management fees, transaction costs or expenses. Indices are unmanaged and one cannot invest directly in an index.

Riskalyze Disclosure: The Risk Number® is a proprietary scaled index developed by Riskalyze to reflect risk for both advisors and their clients. The Risk Number is at the heart of a sophisticated set of tools to precisely measure the appetite and capacity for risk that each client has, and demonstrate their alignment with the portfolios built for them.

Shaped like a speed limit sign, the Risk Number gives advisors and investors a common language to use when setting expectations, recognizing risk and making portfolio selections. Just like driving faster increases hazards, a higher Risk Number equates with higher levels of risk.

General disclosure: This material is intended for information purposes only, and does not constitute investment advice, a recommendation or an offer or solicitation to purchase or sell any securities to any person in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. Reliance upon information in this material is at the sole discretion of the reader. Investing involves risks.

Get in Touch

Ready to take control of your finances and enjoy more of what matters in your life?