by Richard Cull

March Market Recap & Commentary

Commentary

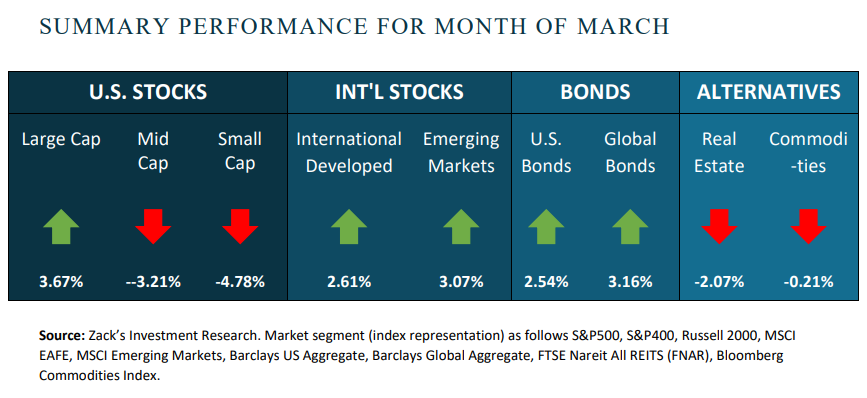

The month of March was unsettling in the banking realm but generally sedate for the markets with most asset classes turning in positive returns. March continued the 2023 theme…Fed watches economy…investors watch Fed.

To recap the last few months, gloom was the overriding sentiment as 2022 ended a particularly difficult year with inflation soaring, interest rates rising, the Fed tightening and the financial markets tanking. January, however, started with a sense of optimism that the Fed was near the end of raising rates and the economy was cooling but not recessing. February tempered some of that enthusiasm as consumer sentiment fell while the resilient labor market gave the Fed additional pretext to raise rates again, hitting the highest level since 2007. March began with relative calm until Silicon Valley Bank (SVB) experienced a bank run on March 10th sending investors and savers directly to the perceived safety of short-term fixed-income (T-Bills, etc).

The purpose of this monthly communication is to provide a summary of the investment landscape. Often that means relaying information about the economy, the jobs market, corporate profitability, consumer sentiment, or a myriad of other items that directly impact investments. The recent “panic” initiated by the SVB failure deserves discussion as the banking system is the main artery in the economic body.

2008 Financial Crisis - Experience during the 2008 Financial Crisis allows us to better understand this current panic. Looking back through a very wide lens, the 2008 crisis began years before the actual crash with cheap credit and lax lending standards fueling a housing bubble. When that bubble burst, the banks were left holding trillions of dollars of worthless subprime mortgages.

Similarities – There are very few semblances in this crisis but they are notable…the seeds were sewn by extremely low interest rates, the banks experienced issues as those rates rose, and a run on one bank spreading to other.

Differences – Honestly too many to list here but the major problems are non-systemic breakdowns. While interest rates rising so sharply are a challenge for all banks, these specific regional banks failed “Banking 101.” Per Federal Reserve Vice Chair for Supervision Michael Barr, SVB “had a concentrated business model, serving the technology and venture capital sector. It also grew exceedingly quickly, tripling in asset size between 2019 and 2022… The bank invested the proceeds of these deposits in longer-term securities, to boost yield and increase its profits. However, the bank did not effectively manage the interest rate risk of those securities or develop effective interest rate risk measurement tools, models, and metrics.” SVB’s depositors were connected by a network of venture capital firms and other ties, and when stress began, they essentially acted together to generate a bank run.

Concluded? – It is highly likely these higher rates will expose more poorly managed banks. And because we use the fractional-reserve-system, negative news will always result in bank runs. The Federal Reserve knows this system is based on trust and were quick to react insuring all deposits even beyond the $250K per account guaranteed by the FDIC.

Reiterating my closing thoughts from last month…”Knowing how these and numerous other themes play out in the short term is impossible.” At Centric Advisors, experience allows us to look beneath the headlines, over the noise, through the volatility and focus on our clients’ long term goals.

Even during panic.

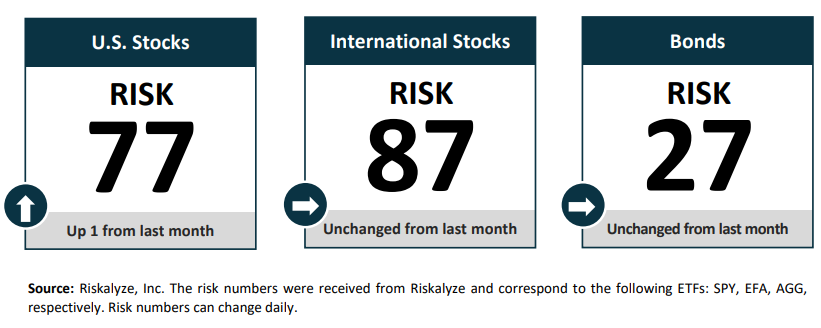

Risk Numbers

The Risk Number is at the heart of a sophisticated set of tools to precisely measure the appetite and capacity for risk that each client has, and demonstrate their alignment with the portfolios built for them. The following graphic shows the risk of various asset classes as measured on a scale of 1-99 (1 being the most conservative and 99 being the most aggressive) as of the date above.

CENTRIC’S Approach

We start with a Risk Number, a measurable way to pinpoint how much risk you want, need, and already have. Then, your wealth advisor will optimally allocate our investments to help you reach your financial goals. Along the way, you will receive transparency of information, seamless proactive service and the trust and accountability you need to stay on track. All of this will lead to your personal comprehensive investment strategy that is powerful, disciplined, responsive.

Sources:

Centric’s Market Assumption Disclosures: This information is not intended as a recommendation to invest in any particular asset class or strategy or product or as a promise of future performance. Note that these asset class assumptions are passive, and do not consider the impact of active management. All estimates in this document are in US dollar terms unless noted otherwise. Given the complex risk-reward trade-offs involved, we advise clients to rely on their own judgment as well as quantitative optimization approaches in setting strategic allocations to all the asset classes and strategies. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Assumptions, opinions and estimates are provided for illustrative purposes only. They should not be relied upon as recommendations to buy or sell securities. Forecasts of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. If the reader chooses to rely on the information, it is at its own risk. This material has been prepared for information purposes only and is not intended to provide, and should not be relied on for, accounting, legal, or tax advice. The outputs of the assumptions are provided for illustration purposes only and are subject to significant limitations. “Expected” return estimates are subject to uncertainty and error. Expected returns for each asset class can be conditional on economic scenarios; in the event a particular scenario comes to pass, actual returns could be significantly higher or lower than forecasted. Because of the inherent limitations of all models, potential investors should not rely exclusively on the model when making an investment decision. The model cannot account for the impact that economic, market, and other factors may have on the implementation and ongoing management of an actual investment portfolio. Unlike actual portfolio outcomes, the model outcomes do not reflect actual trading, liquidity constraints, fees, expenses, taxes and other factors that could impact future returns. Asset allocation/diversification does not guarantee investment returns and does not eliminate the risk of loss.

Index Disclosures: Index returns are for illustrative purposes only and do not represent any actual fund performance. Index performance returns do not reflect any management fees, transaction costs or expenses. Indices are unmanaged and one cannot invest directly in an index.

Riskalyze Disclosure: The Risk Number® is a proprietary scaled index developed by Riskalyze to reflect risk for both advisors and their clients. The Risk Number is at the heart of a sophisticated set of tools to precisely measure the appetite and capacity for risk that each client has, and demonstrate their alignment with the portfolios built for them.

Shaped like a speed limit sign, the Risk Number gives advisors and investors a common language to use when setting expectations, recognizing risk and making portfolio selections. Just like driving faster increases hazards, a higher Risk Number equates with higher levels of risk.

General disclosure: This material is intended for information purposes only, and does not constitute investment advice, a recommendation or an offer or solicitation to purchase or sell any securities to any person in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. Reliance upon information in this material is at the sole discretion of the reader. Investing involves risks.

Get in Touch

Ready to take control of your finances and enjoy more of what matters in your life?