by Richard Cull

November 2022 Market Recap & Commentary

Commentary

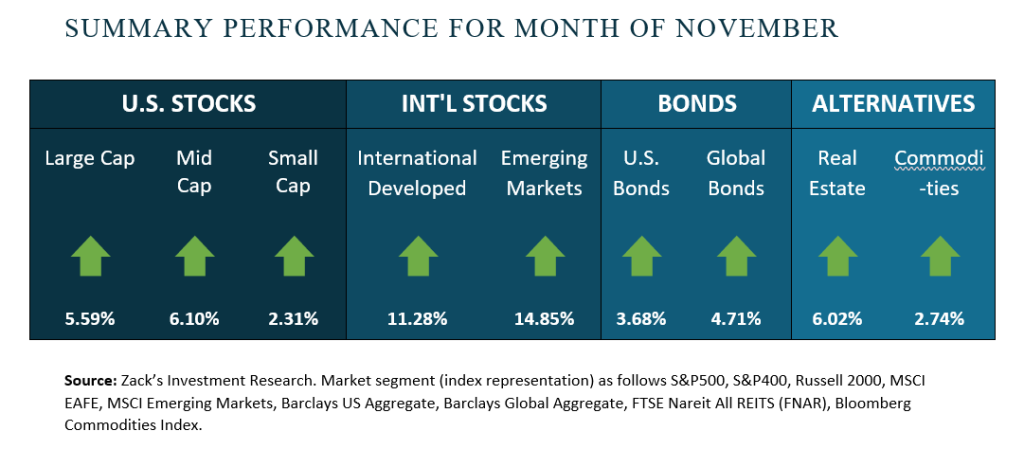

November was the second positive month in a row for the markets…usually nothing to get excited about…but these are difficult times.

As reviewed over the past several commentaries, the three major themes behind the markets continue to be 1) inflation, 2) a tightening Fed and 3) a potential recession.

The good news: 1) inflation - signs of easing pressure continue to appear. Supply chains are finally back to normal after two years of pandemic-related hitches as evidenced by the number of cargo ships waiting to unload in Southern California down from over 100+ to just six. Additionally, one of the big categories within the most widely followed inflation gauge (CPI) is the owners’ equivalent rent component which makes up about 25% of the entire CPI and measures what an owner would pay if they rented their house. This category is falling rapidly as rising mortgage rates pull many buyers out of the market.

More good news: 2) tightening Fed – several Fed members have said publicly the pace of rate hikes may slow sooner rather than later. Seemingly counter to the body’s steep 75 basis point hike in early November, Fed Chairman Jay Powell said the pace of hikes could slow as early as December’s meeting. While no Fed Governors are signaling a pivot from rate hikes to rate cuts, the markets are higher on the less hawkish rhetoric.

Less good news: 3) potential recession – the economy continues to show conflicting data. Certain pockets, such as manufacturing, are slowing while others, notably travel, grow stronger. In the aggregate, consumers have spent down their excess savings accumulated during the pandemic and increased credit use. Several retailers are warning of reduced foot traffic, growing inventories and shoppers focusing more on need versus want purchases.

The most important measure of U.S. consumers is the unemployment rate which continues to hover near 50 years lows. Traditionally as long as Americans have jobs, they spend money regardless of interest rates, inflation, bad news, etc. While this is great news for main street, it makes the Fed’s goal of reducing inflation almost impossible. The jobs report released the first Friday of every month has become must-watch for the Fed who clearly wants slow the pace of rate hikes but acknowledges unemployment must rise for inflation to fall.

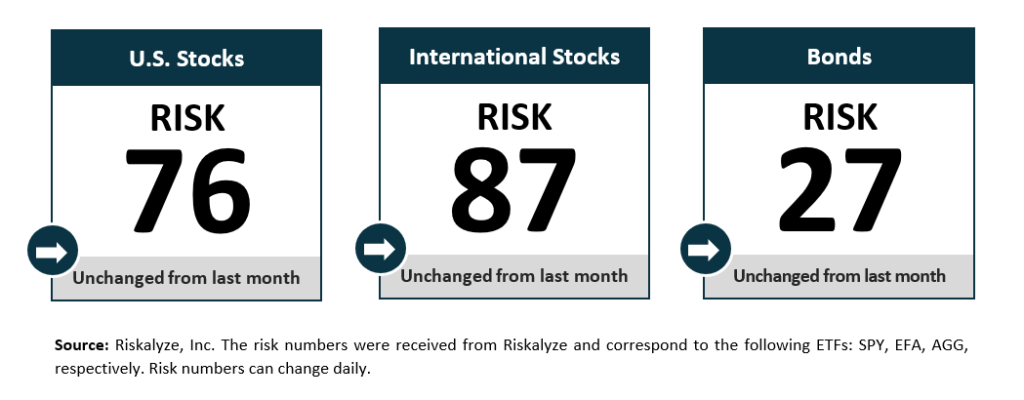

Risk Numbers

The Risk Number is at the heart of a sophisticated set of tools to precisely measure the appetite and capacity for risk that each client has, and demonstrate their alignment with the portfolios built for them. The following graphic shows the risk of various asset classes as measured on a scale of 1-99 (1 being the most conservative and 99 being the most aggressive) as of the date above.

CENTRIC’S Approach

We start with a Risk Number, a measurable way to pinpoint how much risk you want, need, and already have. Then, your wealth advisor will optimally allocate our investments to help you reach your financial goals. Along the way, you will receive transparency of information, seamless proactive service and the trust and accountability you need to stay on track. All of this will lead to your personal comprehensive investment strategy that is powerful, disciplined, responsive.

Sources:

Centric’s Market Assumption Disclosures: This information is not intended as a recommendation to invest in any particular asset class or strategy or product or as a promise of future performance. Note that these asset class assumptions are passive, and do not consider the impact of active management. All estimates in this document are in US dollar terms unless noted otherwise. Given the complex risk-reward trade-offs involved, we advise clients to rely on their own judgment as well as quantitative optimization approaches in setting strategic allocations to all the asset classes and strategies. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Assumptions, opinions and estimates are provided for illustrative purposes only. They should not be relied upon as recommendations to buy or sell securities. Forecasts of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. If the reader chooses to rely on the information, it is at its own risk. This material has been prepared for information purposes only and is not intended to provide, and should not be relied on for, accounting, legal, or tax advice. The outputs of the assumptions are provided for illustration purposes only and are subject to significant limitations. “Expected” return estimates are subject to uncertainty and error. Expected returns for each asset class can be conditional on economic scenarios; in the event a particular scenario comes to pass, actual returns could be significantly higher or lower than forecasted. Because of the inherent limitations of all models, potential investors should not rely exclusively on the model when making an investment decision. The model cannot account for the impact that economic, market, and other factors may have on the implementation and ongoing management of an actual investment portfolio. Unlike actual portfolio outcomes, the model outcomes do not reflect actual trading, liquidity constraints, fees, expenses, taxes and other factors that could impact future returns. Asset allocation/diversification does not guarantee investment returns and does not eliminate the risk of loss.

Index Disclosures: Index returns are for illustrative purposes only and do not represent any actual fund performance. Index performance returns do not reflect any management fees, transaction costs or expenses. Indices are unmanaged and one cannot invest directly in an index.

Riskalyze Disclosure: The Risk Number® is a proprietary scaled index developed by Riskalyze to reflect risk for both advisors and their clients. The Risk Number is at the heart of a sophisticated set of tools to precisely measure the appetite and capacity for risk that each client has, and demonstrate their alignment with the portfolios built for them.

Shaped like a speed limit sign, the Risk Number gives advisors and investors a common language to use when setting expectations, recognizing risk and making portfolio selections. Just like driving faster increases hazards, a higher Risk Number equates with higher levels of risk.

General disclosure: This material is intended for information purposes only, and does not constitute investment advice, a recommendation or an offer or solicitation to purchase or sell any securities to any person in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. Reliance upon information in this material is at the sole discretion of the reader. Investing involves risks.

Get in Touch

Ready to take control of your finances and enjoy more of what matters in your life?