by Richard Cull

October 2021 Market Recap & Commentary

Commentary

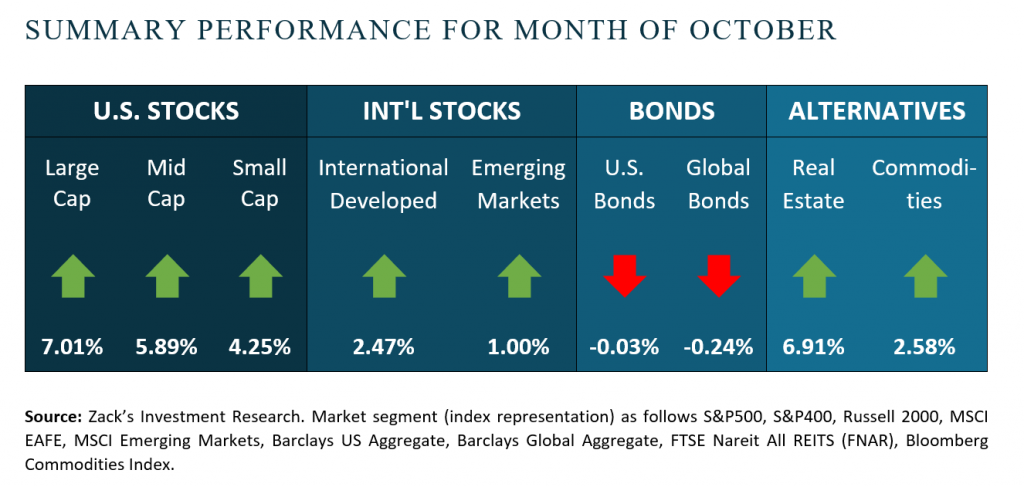

The month of October, considered “spooky” by some market pundits, produced very solid returns across almost all asset classes.

Previous headlines concerning the Delta variant, the Chinese real estate developer Evergrande and the looming US debt limit faded during the month. The news cycle replaced these with increased coverage of rising inflation, the disjointed labor market and the worsening supply bottleneck. It reminds me of the early days of CNN (Cable News Network) launched in 1980 by Ted Turner that was the first television channel to provide 24 hour news coverage. Amid their endless stories, the most recent (Breaking News is the media's term, Recency Bias is the behavioral finance term) garnered the most emphasis, only outdone by frequent CRISES.

All of the challenges covered in the financial media must be acknowledged yes, but then evaluated through a lens of objectivity and experience.

Case in Point: despite the worrisome narrative, the equity markets moved meaningfully higher over the latter part of the month. Why? Companies began reporting robust third quarter results. With close to half of the S&P 500 companies reporting thus far, total revenues and earnings are up 15.3% and 37.6%, respectively from the same period last year, with 82.3% beating EPS estimates. Inflation, labor issues and supply constraints certainly affected these results, but strong consumer demand allowed companies to pass part of these costs through with price increases.

Can we extrapolate these returns out for the rest of the year? We are very optimistic that the two of the most powerful fundamentals, consumer demand and corporate earnings, will remain strong. At some point however, the markets will start looking past the COVID pent up demand and begin worrying about peak earnings or a myriad of potential other challenges.

Risk Numbers

The Risk Number is at the heart of a sophisticated set of tools to precisely measure the appetite and capacity for risk that each client has, and demonstrate their alignment with the portfolios built for them. The following graphic shows the risk of various asset classes as measured on a scale of 1-99 (1 being the most conservative and 99 being the most aggressive) as of the date above.

Sources:

Centric’s Market Assumption Disclosures: This information is not intended as a recommendation to invest in any particular asset class or strategy or product or as a promise of future performance. Note that these asset class assumptions are passive, and do not consider the impact of active management. All estimates in this document are in US dollar terms unless noted otherwise. Given the complex risk-reward trade-offs involved, we advise clients to rely on their own judgment as well as quantitative optimization approaches in setting strategic allocations to all the asset classes and strategies. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Assumptions, opinions and estimates are provided for illustrative purposes only. They should not be relied upon as recommendations to buy or sell securities. Forecasts of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. If the reader chooses to rely on the information, it is at its own risk. This material has been prepared for information purposes only and is not intended to provide, and should not be relied on for, accounting, legal, or tax advice. The outputs of the assumptions are provided for illustration purposes only and are subject to significant limitations. “Expected” return estimates are subject to uncertainty and error. Expected returns for each asset class can be conditional on economic scenarios; in the event a particular scenario comes to pass, actual returns could be significantly higher or lower than forecasted. Because of the inherent limitations of all models, potential investors should not rely exclusively on the model when making an investment decision. The model cannot account for the impact that economic, market, and other factors may have on the implementation and ongoing management of an actual investment portfolio. Unlike actual portfolio outcomes, the model outcomes do not reflect actual trading, liquidity constraints, fees, expenses, taxes and other factors that could impact future returns. Asset allocation/diversification does not guarantee investment returns and does not eliminate the risk of loss.

Index Disclosures: Index returns are for illustrative purposes only and do not represent any actual fund performance. Index performance returns do not reflect any management fees, transaction costs or expenses. Indices are unmanaged and one cannot invest directly in an index.

Riskalyze Disclosure: The Risk Number® is a proprietary scaled index developed by Riskalyze to reflect risk for both advisors and their clients. The Risk Number is at the heart of a sophisticated set of tools to precisely measure the appetite and capacity for risk that each client has, and demonstrate their alignment with the portfolios built for them.

Shaped like a speed limit sign, the Risk Number gives advisors and investors a common language to use when setting expectations, recognizing risk and making portfolio selections. Just like driving faster increases hazards, a higher Risk Number equates with higher levels of risk.

General disclosure: This material is intended for information purposes only, and does not constitute investment advice, a recommendation or an offer or solicitation to purchase or sell any securities to any person in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. Reliance upon information in this material is at the sole discretion of the reader. Investing involves risks

Get in Touch

Ready to take control of your finances and enjoy more of what matters in your life?