by Richard Cull

YEAR END 2022 MARKET RECAP & COMMENTARY

“The stock market Is the story of cycles and of the human behavior that is responsible for

overreactions in both directions.”

Seth Klarman

Based on recurring questions from clients over the years, we find it helpful to distinguish our recaps/analysis/forecast between news observed in everyday life (Main St.) and that gleaned in the investment arena (Wall St.).

THE YEAR ON MAIN STREET

As we get further from the crazy pandemic years, time seems to accelerate. 2022, labeled “The Great Reopening”, is the latest such occurrence.

The year saw a myriad of newsworthy events including new global strife (Russian invasion of Ukraine, protests in Iran, China's war games near Taiwan), continued climate disasters (floods, crop-wilting droughts, record heat waves), perpetual government turnover (U.S. midterm elections, new prime ministers in the UK and Malaysia), and of course rare events (passing of Queen Elizabeth, reversal of Row v. Wade).

U.S consumer’s budgets were most effected by a spike in gasoline prices (going north of $5/ gallon), the more than doubling of mortgage rates (from under 3% to over 7%), highest credit card rates on record (19.77%) and the price of everything rising daily (inflation at levels not seen since 1974).

As was the case in 2020 & 2021, Americans adapted and moved forward.

THE YEAR ON WALL STREET

Years like 2022 are exactly why we separate Main Street from Wall Street. As highlighted above, daily life seemed to rise above the news cycle, a lot of which was negative. The investment markets, alternatively, focused on a limited set of data, most of which was positive, and turned in one of the worst years in memory.

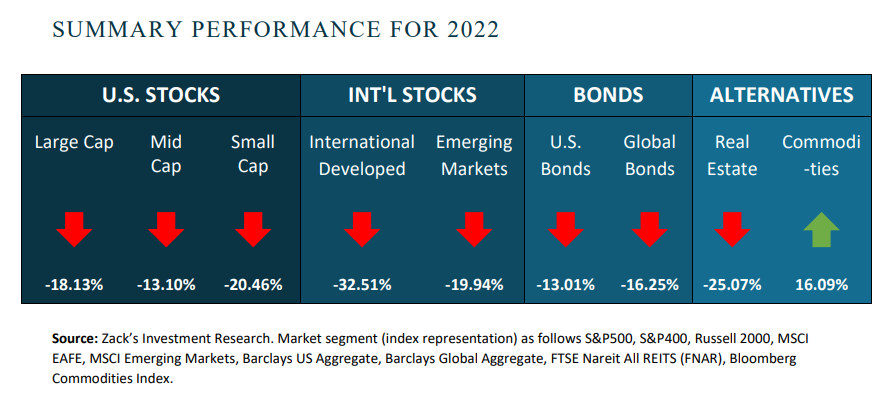

Stocks had their worst year since 2008 (S&P 500 -18.1%, NASDAQ -32.5%), bonds had their worst year on record (intermediate bond proxy AGG -13.0%), and alternatives (real estate, cryptocurrencies, etc) saw significant losses. Only certain commodities (Oil, uranium, iron ore, etc.) turned in positive numbers and even those saw meaningful pullbacks the second half of the year.

Normally during periods of stress in the financial markets investors sell stocks and buy bonds, reinforcing the cornerstone of Modern Portfolio Theory (diversification). The breakdown of this diversification in 2022 was a very rare occurrence. How rare? Out of the 196 quarterly rolling 12-month periods since 1973 this has only occurred four times (2%)!

THE YEAR AHEAD

The calendar has changed but most of the fundamentals underpinning the financial markets have not.

Past: The economy, consumer spending, and corporate profits remained strong throughout 2022. Rising interest rates, however, drove selling across all asset classes as investors reset expectations and valuations lower.

Present: The positives include historically low unemployment, an expanding economy and healthy consumer spending. The negatives include a high level of inflation, the continued war in Ukraine and the Fed’s tight money policy.

Future: Based on the current price level of stocks and inversion of the yield curve (two year bonds yielding more than 10 year bonds), the markets are anticipating an economic recession in 2023. The sharp pace of Fed rate hikes has created pockets of weakness in some areas (housing, etc) and analysts are bracing for other delayed effects (rising unemployment, lower consumer spending, and falling corporate profits).

The fundamentals for the year ahead are not as strong and the security valuations reflect this. Consumer spending (which makes up 67% of the economy) will determine if / when / to what degree the U.S. enters a recession. The first quarter should provide an early window of what to expect in 2023 as we parse the latest data on corporate profitability, post-holiday consumer spending and business’ forecast for hirings/ firings.

CENTRIC'S APPROACH

Our task is to grow our clients’ assets by investing in tradeable financial assets. To that end, we believe investing is a discipline built on a process developed through extensive education, analysis, and experience.

At CENTRIC, we build diversified portfolios tailored to our individual clients. Our discipline is to focus on the LONG-TERM and ignore the noise, identify QUALITY and be mindful of fads, and understand the FUNDAMENTALS and not simply follow the herd.

About the headline quote: We chose the phrase by Seth Klarman as the U.S. economic cycle will be a major theme in 2023. One of the all-time great investors, Mr. Klarman so accurately surmises that the stock market is an extension of the business cycle infused with human emotion…often resulting in overreaction.

Sources:

Centric’s Market Assumption Disclosures: This information is not intended as a recommendation to invest in any particular asset class or strategy or product or as a promise of future performance. Note that these asset class assumptions are passive, and do not consider the impact of active management. All estimates in this document are in US dollar terms unless noted otherwise. Given the complex risk-reward trade-offs involved, we advise clients to rely on their own judgment as well as quantitative optimization approaches in setting strategic allocations to all the asset classes and strategies. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Assumptions, opinions and estimates are provided for illustrative purposes only. They should not be relied upon as recommendations to buy or sell securities. Forecasts of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. If the reader chooses to rely on the information, it is at its own risk. This material has been prepared for information purposes only and is not intended to provide, and should not be relied on for, accounting, legal, or tax advice. The outputs of the assumptions are provided for illustration purposes only and are subject to significant limitations. “Expected” return estimates are subject to uncertainty and error. Expected returns for each asset class can be conditional on economic scenarios; in the event a particular scenario comes to pass, actual returns could be significantly higher or lower than forecasted. Because of the inherent limitations of all models, potential investors should not rely exclusively on the model when making an investment decision. The model cannot account for the impact that economic, market, and other factors may have on the implementation and ongoing management of an actual investment portfolio. Unlike actual portfolio outcomes, the model outcomes do not reflect actual trading, liquidity constraints, fees, expenses, taxes and other factors that could impact future returns. Asset allocation/diversification does not guarantee investment returns and does not eliminate the risk of loss.

Index Disclosures: Index returns are for illustrative purposes only and do not represent any actual fund performance. Index performance returns do not reflect any management fees, transaction costs or expenses. Indices are unmanaged and one cannot invest directly in an index.

Riskalyze Disclosure: The Risk Number® is a proprietary scaled index developed by Riskalyze to reflect risk for both advisors and their clients. The Risk Number is at the heart of a sophisticated set of tools to precisely measure the appetite and capacity for risk that each client has, and demonstrate their alignment with the portfolios built for them.

Shaped like a speed limit sign, the Risk Number gives advisors and investors a common language to use when setting expectations, recognizing risk and making portfolio selections. Just like driving faster increases hazards, a higher Risk Number equates with higher levels of risk.

General disclosure: This material is intended for information purposes only, and does not constitute investment advice, a recommendation or an offer or solicitation to purchase or sell any securities to any person in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. Reliance upon information in this material is at the sole discretion of the reader. Investing involves risks.

Get in Touch

Ready to take control of your finances and enjoy more of what matters in your life?