by Richard Cull

YEAR END 2023 MARKET RECAP & COMMENTARY

So, she tasted the last bowl of porridge.

“Ahhh, this porridge is just right,”

she said happily and she ate it all up.

Goldilocks and the Three Bears

THE YEAR ON MAIN STREET

Life seems to be settling into a new normal as we moved another year away from the COVID lockdown. While it has been a couple of years, that distortion continues to affect people on sociological and economical levels.

The year saw a continuation of 2022 events including Russia’s war with Ukraine, heightened US-China tensions, and continued climate challenges (global temperatures shattered records). The year also included new events including an unforeseen regional bank crisis, the mainstream awareness of artificial intelligence, and the Oct 7th invasion of Israel by Hamas.

U.S consumer budgets continued to be stretched by higher mortgage rates (briefly hitting 8%), higher credit card rates (22.77%), and the price of everything still rising (thankfully at a slower pace than 2022).

Despite that, the year must be considered a success—especially considering the gloom heading into it. The consensus opinion called for a 2023 recession in the U.S. but did not materialize as strong employment and steady consumer spending lifted GDP.

THE YEAR ON WALLSTREET

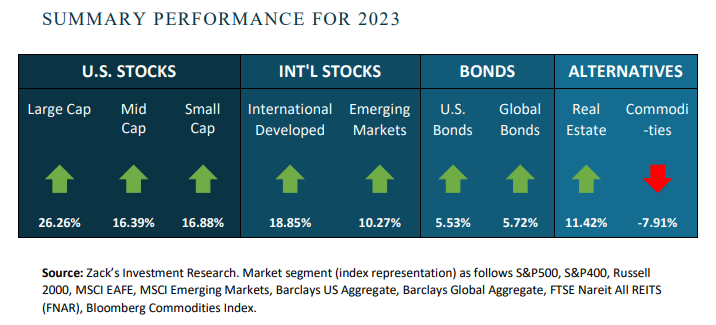

2022 was one of the worst years in the financial markets as everything turned in meaningfully negative returns. 2023 thankfully, was a mirror image with almost everything turning in meaningfully positive returns.

Through the first ten months of 2023 however, stocks were slightly negative except for the “Magnificent Seven”, a small group of tech stocks that rode the artificial intelligence (A.I.) craze. Those stocks’ large size and large returns distorted the market indexes (accounted for 2/3rds of the S&P 500 return) and hid the fact that the average stock was well below its 2021 high.

The last two months of the year brough a very violent, very broad rally…ending on a nine-week winning streak, the longest consecutive run of weekly gains since 2004.

The impetus for the surge- two Federal Reserve meetings with no rate hikes and hints that the tightening cycle has ended. Taken with falling inflation, still historically low unemployment, and an expanding economy, the market believes the Fed has engineered a “soft landing” and we are now in a “Goldilocks” market.

THE YEAR AHEAD

The financial markets were down significantly in 2022 and then rebounded in 2023...we start the new year almost exactly where we were in December 2021!

Past: Resilient consumer spending buoyed the economy in the face of elevated inflation and higher interest rates. Almost all asset classes finished strong as investors anticipated the end of the Fed’s tightening cycle.

Current: In addition to a less hawkish Fed, the positives include historically low unemployment, an expanding economy, healthy consumer spending, lower rates of inflation, and forecasted corporate earnings growth. The negatives include the continued war in Ukraine, tense situation in the Middle East, above-average valuation for stocks, and the depletion of the COVID stimulus ($2.1 trillion in excess consumer savings).

Future: The widely anticipated recession did not materialize in 2023. Despite the sharp pace of Fed rate hikes and unanticipated regional banking crisis, consumer confidence and thus spending did not waver.

The backdrop for the year ahead is “Goldilocks” and the security valuations reflect this. As the markets are forward looking, valuations are a measure of expectations. Current valuations are slightly elevated for stocks in general and significantly elevated for the “Magnificent Seven” and certain other A.I. stocks, meaning the market is very optimistic about 2024. Economist and seasoned market pundits, however, feel it’s too early for the all-clear signal and cite possible delayed affects from higher rates such as increased delinquencies, increased bankruptcies, decreased hirings, and increased pressure on corporate earnings.

CENTRIC'S APPROACH

Our task is to grow our clients’ assets by investing in tradeable financial assets. To that end, we believe investing is a discipline built on a process developed through extensive education, analysis, and experience.

At CENTRIC, we build diversified portfolios tailored to our individual clients. Our discipline is to focus on the LONG-TERM and ignore the noise, identify QUALITY and be mindful of fads, and understand the FUNDAMENTALS and not simply follow the herd.

About the headline quote: We chose the phrase from the 19th-century fairy tale as it captures the financial markets feeling about 2024. Let’s hope the pundits continue to be wrong and we don’t wake up facing three hunger bears.

Sources:

Centric’s Market Assumption Disclosures: This information is not intended as a recommendation to invest in any particular asset class or strategy or product or as a promise of future performance. Note that these asset class assumptions are passive, and do not consider the impact of active management. All estimates in this document are in US dollar terms unless noted otherwise. Given the complex risk-reward trade-offs involved, we advise clients to rely on their own judgment as well as quantitative optimization approaches in setting strategic allocations to all the asset classes and strategies. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Assumptions, opinions and estimates are provided for illustrative purposes only. They should not be relied upon as recommendations to buy or sell securities. Forecasts of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. If the reader chooses to rely on the information, it is at its own risk. This material has been prepared for information purposes only and is not intended to provide, and should not be relied on for, accounting, legal, or tax advice. The outputs of the assumptions are provided for illustration purposes only and are subject to significant limitations. “Expected” return estimates are subject to uncertainty and error. Expected returns for each asset class can be conditional on economic scenarios; in the event a particular scenario comes to pass, actual returns could be significantly higher or lower than forecasted. Because of the inherent limitations of all models, potential investors should not rely exclusively on the model when making an investment decision. The model cannot account for the impact that economic, market, and other factors may have on the implementation and ongoing management of an actual investment portfolio. Unlike actual portfolio outcomes, the model outcomes do not reflect actual trading, liquidity constraints, fees, expenses, taxes and other factors that could impact future returns. Asset allocation/diversification does not guarantee investment returns and does not eliminate the risk of loss.

Index Disclosures: Index returns are for illustrative purposes only and do not represent any actual fund performance. Index performance returns do not reflect any management fees, transaction costs or expenses. Indices are unmanaged and one cannot invest directly in an index.

Riskalyze Disclosure: The Risk Number® is a proprietary scaled index developed by Riskalyze to reflect risk for both advisors and their clients. The Risk Number is at the heart of a sophisticated set of tools to precisely measure the appetite and capacity for risk that each client has, and demonstrate their alignment with the portfolios built for them.

Shaped like a speed limit sign, the Risk Number gives advisors and investors a common language to use when setting expectations, recognizing risk and making portfolio selections. Just like driving faster increases hazards, a higher Risk Number equates with higher levels of risk.

General disclosure: This material is intended for information purposes only, and does not constitute investment advice, a recommendation or an offer or solicitation to purchase or sell any securities to any person in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. Reliance upon information in this material is at the sole discretion of the reader. Investing involves risks.

Get in Touch

Ready to take control of your finances and enjoy more of what matters in your life?